Arista Networks (ANET)

Arista Networks (ANET) is a leader in networking for large data centers, campus, and routing environments.

Arista has consistently disrupted the networking market with its innovative software-defined networking (SDN) solutions and high-performance hardware. The company is poised to benefit from the continued growth of cloud computing, artificial intelligence, increasing demand for bandwidth, and the need for more agile and scalable network infrastructure. Arista’s strong product portfolio, continuing innovation, and excellent leadership position the company for sustained success.

Source: Arista Networks

Arista’s business model is centered around the following key areas:

Hardware: Arista designs and sells high-performance network switches and other hardware products optimized for datacenter, campus, and routing environments.

Software: Arista’s EOS (Extensible Operating System) is a network operating system that provides advanced features such asSDN, automation, and network visibility.

Services: Arista offers a range of services, including consulting, training, and support, to help customers deploy and manage their networks.

Given the company specializes in serving the high end of the market, they do have revenue concentration with leading tech players, most specifically Microsoft and Meta.

Arista Networks is benefiting from several key industry trends:

1. Cloud Adoption: The ongoing migration of workloads to the cloud is driving demand for high-performance networking solutions that can handle the increasing volume of data traffic.

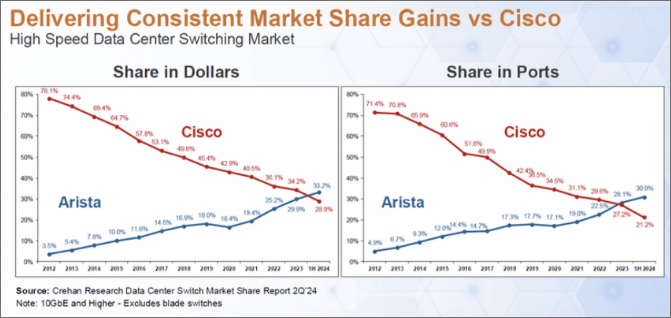

2. Data Center Modernization: Enterprises are modernizing their data centers to improve efficiency, reduce costs, and support new applications. This is creating opportunities for Arista’s SDN solutions, which offer greater automation, visibility, and control over network resources. For many years, Arista has been taking share from Cisco in this market, a trend we expect will continue.

3. AI and Machine Learning: The rise of AI and machine learning is driving demand for high- bandwidth, low-latency networks that can support these compute-intensive workloads.

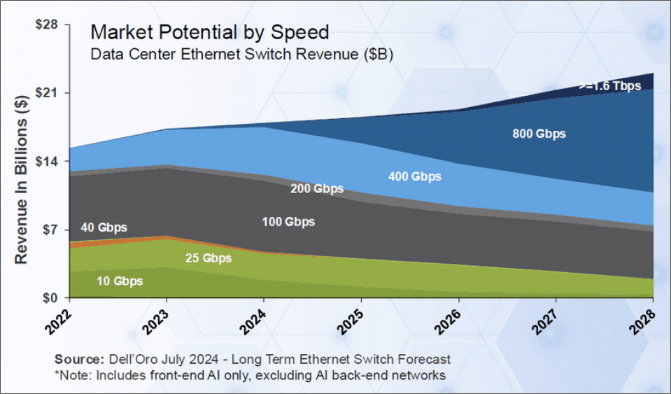

These trends above can be summarized by evaluating one factor: speed. Each advancement in technology – from the shift to the cloud, to the development and use of AI – all demand greater speed than the prior technology. Arista, being the leader at the highest speed sand continuing to push the limits, is well positioned to continue to lead the market as new technologies emerge.

Source: Arista Networks

Arista differentiates itself from competitors through:

Software-Driven Approach: Arista’s EOS is a key differentiator, providing advanced features and capabilities that are not available in traditional networking solutions.

Innovation: Arista has a strong track record of innovation, consistently introducing new products and features that address the evolving needs of its customers.

Open Architecture: Arista embraces open-source technologies, allowing customers to integrate its solutions with other open-source tools and platforms. This is in contrast to Cisco (their main competitor) who takes a “walled garden” approach.

We took an initial 2% position in Arista. While we are bullish on the company’s long term prospects and believe in the AI opportunity long term, we do expect there to be some volatility along the way as the market digests AI headlines and evaluates ROIs of the emerging technology. We would look to add to the position over time.

Disclosure: This document has been prepared for informational purposes only and does not constitute, either explicitly or implicitly, any specific investment advice, recommendations, or offers to buy or sell any securities. Sandhill Investment Management (“Sandhill”) is a registered investment adviser with the Securities and Exchange Commission and is not affiliated with any parent company. All statements regarding companies, securities, or other financial information contained in the content represent the views and opinions of Sandhill as of the date of this commentary and are subject to change without notice. Any forward-looking statements, including expectations for growth or potential outcomes, are speculative in nature and should not be relied upon as assurances of future performance or investment success. Past performance is not indicative of future results. Investments in equities involve risks, including potential loss of principal, and may be subject to factors such as economic, political, or market changes, as well as company-specific developments. References to portfolio positions, including the size of any holdings, are for illustrative purposes only and are not intended as investment advice or recommendations. Any decisions about investing should be made based on an individual’s objectives, financial situation, and risk tolerance, in consultation with a qualified financial professional. Third-party information discussed has been obtained from sources believed to be accurate; however, Sandhill makes no guarantee as to the accuracy or completeness of this information. For a complete list and description of firm composites, please call 716-852-0279.